Home

Products

Products Overview

Core Products

Services

Technology

Solutions

Partners

Resources

Latest News and Updates

Case studies

Product Updates

e-Articles

Building and Operating Compliant Systems

Enhancing Customer Experience

Gaining Competitive Advantage

Increasing Operational Efficiency and Agility

Increasing Sales and Distribution Efficiency

Boosting Customer Retention and Engagement

Successfully Migrating from Legacy Systems

Improving Risk Management and Underwriting

About

Company

Legal

Contact us

Partners

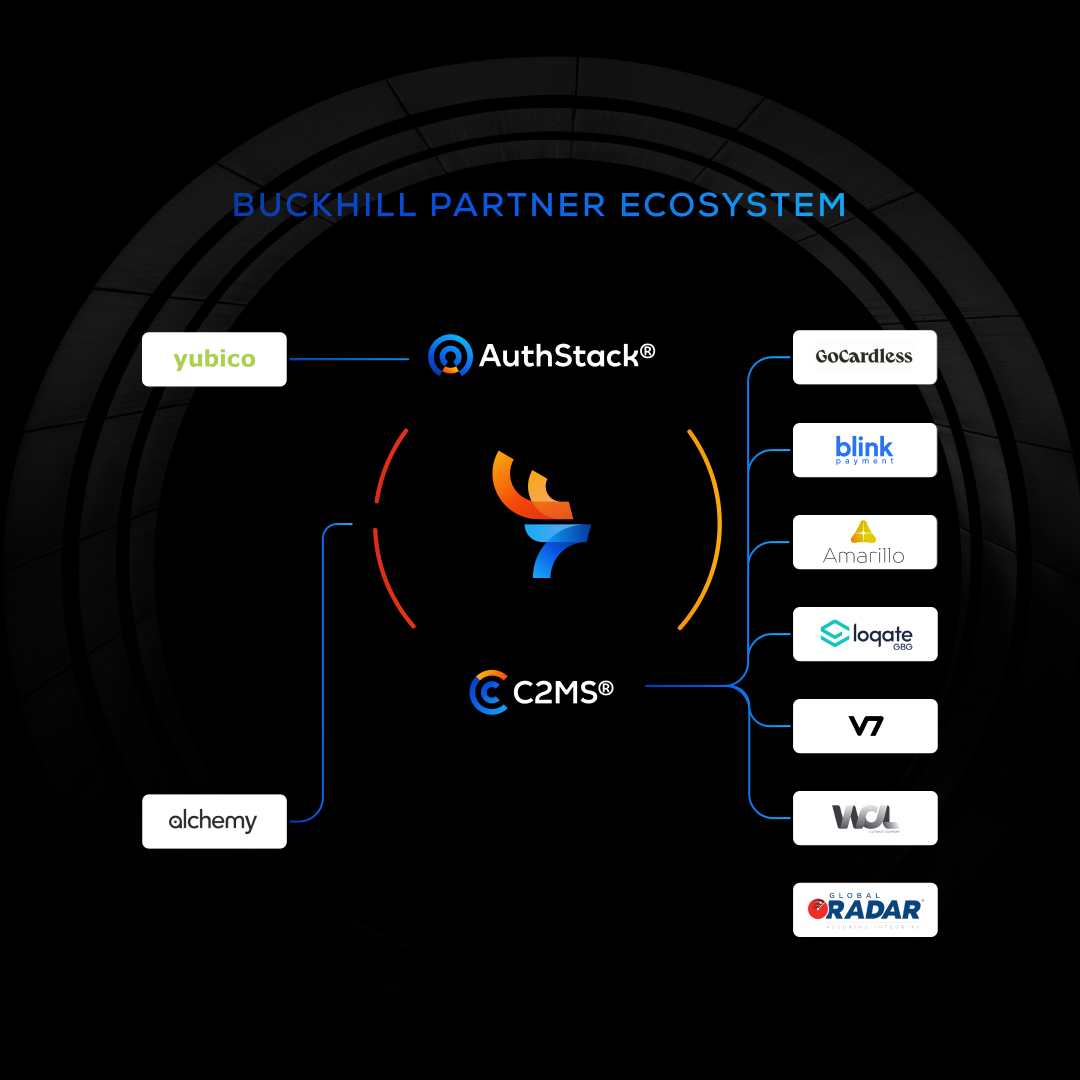

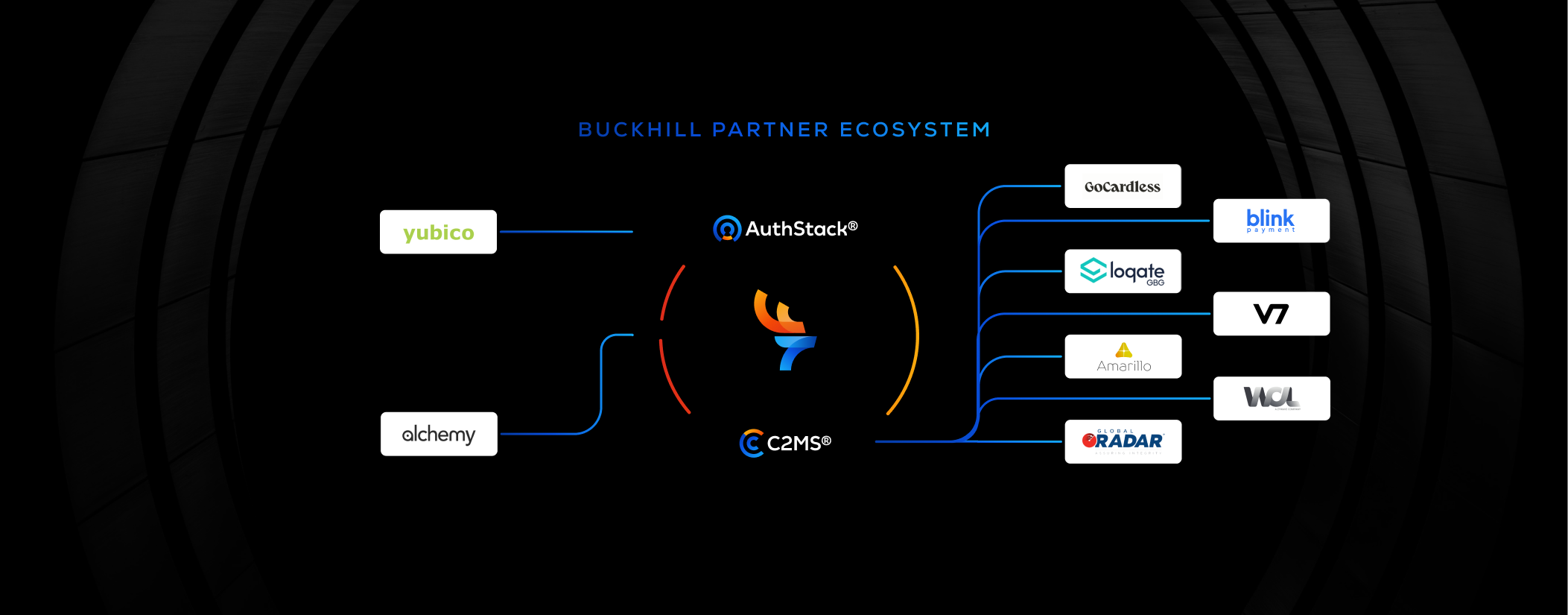

Our Partner Ecosystem

Meet Our Partners

.01

Technology Partners

AWS Technology Partner

Google Cloud Partner

Microsoft Cloud Solution Provider

Microsoft Azure

Powering Your Success Through

.

.05

Read More on our Partnerships Here

Become a Partner

United Kingdom

Croatia

Products

Services

Contact us 8am - 6pm GMT (Mon-Fri)

.svg.png)

.png)